How to apply the law of cause and effect in your financial life

THE LAW OF CAUSE AND EFFECT

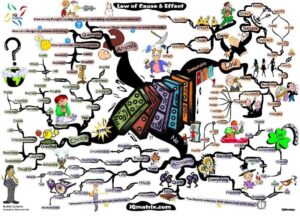

The law of cause and effect is one of the greatest laws in the universe. It says for every effect there must be a cause and for every cause there must be an effect.

The law of cause and effect says that there is always a reason for anything that happens. Every effect has a cause, whether you know what it is or not.

This simply means, if you can be precise about what you want to achieve, such as financial confidence, you simply search and know what other successful people do, and you duplicate it. Success is not an accident neither is Failure is an accident.

The principle of cause and effect is an interesting one because a lot of people aren’t aware of it, they think that things happen by chance.

This is false actually, because every cause has its effect and every effect has its cause. Everything has a definite aim, nothing happens by luck or chance. It might seem to appear so, if you are not aware of all the other information available for situation.

One of the best ways to explain the law of cause and effect is using Finance and prosperity. If you understand it in prosperity then you can relate it to other aspects in your life.

Factors that affects the cause and effects of your financial results.

1. Limiting Beliefs:

If you believe that you can earn about 1 million dollars a year and you believe( not just at a conscious level but also at a subconscious level), chances are you’re going to take action towards achieving that goal no matter what.

If however you have limiting beliefs like you’re not good enough or smart enough or worthy or skilled enough, chances are you’re not going to take action.

“Your Beliefs Determine Your Success”

The greatest single fear and a common reason of distress, is the fear of failure. In this area it is called, the fear of poverty and the fear of loss.

One of the deepest needs of human nature is security, any fear of your security, real or imaginary, can cause you tremendous stress.

Happiness exists naturally in the absence of fears and negative emotions. Worrying about money deprives you of happiness

2. Self image and worth:

Your self-image and self-worth is an important part of whether you will take action to achieve your goals or not. If your goals and dreams is bigger than your self image, it can be destroyed by it. Self image is quite different from self esteem.

Self image is simply how you see yourself, while self esteem is how you feel about yourself. You can increase your self image through

Daily Affirmations(very important): eg. “I am so happy and grateful for the fact that, I earn (input the amount of money you want) every month.

Read financial books that will change how you see yourself.

Take financial courses

And lastly surround yourself with financially successful people. It Is said that, if you surround yourself with 5 successful person’s you will be the 6th one. This statement is true. All this will change how you see yourself.

3. Emotions:

Emotions are triggered in the subconscious mind

For example, if you think of achieving a financial goal or a life goal that you have, but at the emotional level of your subconscious mind, you believe that there is any real or potential danger or risk of you either losing money.

Or you getting hurt, being embarrassed, ashamed etc. Motivational centers in the brain gets deactivated and also the genius left pre-frontal cortex of the brain(helps set and achieve goals) goes offline.

And that prevents you from really coming up with ways and solutions and strategies and tactics to take action

4. Habits:

Let me give a good example for this

Let’s assume you want to make up to 500 thousand dollars in a year and you have the habits of 50 thousand dollars, you will only make 50 thousand dollars. It applies for any other amount you want to make

Listen and read well

We are creatures of habits and we repeat our habitual patterns over and over and over again. That is our brain’s way of conserving energy and keeping us in our comfort zone. So if you don’t have the habits to double or triple your income, if you don’t have the daily, weekly and monthly behaviors that will help you achieve the financial lifestyle goals that you want

You won’t be able to achieve your set goals and objectives.

How to apply the law of cause and effect in your financial life

1. Set a vision for yourself

2. Set a financial goal that will enable you live the vision

3. Discover what successful people did to become financially confident and discipline yourself to do the same.

4. Invest in Yourself:

8 ways to improve yourself

Improve your skills and expertise:

Spend 10% of your personal time and money on improving yourself

Personal time:

Find and spend time towards working on your personal goals.

Creative outlets:

Step out of your comfort zone

Personal health:

Eat healthy, exercise, read, write, think and socialize

Make a plan:

Track your goal and measure your progress

Invest in happiness:

Focus on the things that makes you happy

Invest in your relationships

Invest in your financial wellbeing

CONCLUSION

The law of cause and effect is one of the greatest laws on earth. It works whether you like it or not. It’s better to take advantage of it. I only used finance as a example, it is also applicable in all other aspects of your life.

Do the cause and get the effect.